Greg Karazulas

Life Settlements Broker

~ Serving Clients Since 1982 ~

941-214-0696

Unlock Your Policy's Potential with Expert Life Settlements

We help seniors explore the hidden value of their unwanted or unaffordable life insurance policies. We’re here to guide you with compassion and clarity, offering non-binding complimentary policy appraisals to help you understand the full value of your assets, and help you make the best decision for yourself, your loved ones and your legacy.

Unlock Your Policy's Potential with Expert Life Settlements

We help seniors explore the hidden value of their unwanted or unaffordable life insurance policies. We’re here to guide you with compassion and clarity, offering non-binding complimentary policy appraisals to help you understand the full value of your assets, and help you make the best decision for yourself, your loved ones and your legacy.

Click Play to Learn More About Life Settlements:

Click Play to Learn More:

Greg Karazulas

Licensed Life Settlement Broker

~Serving Clients Since 1982~

Greg is not only a licensed life settlement broker but also a licensed insurance professional with over 40 years of experience. Over the years, he has helped seniors, families, retirees, and business owners with tailored strategies for wealth protection, life settlements, retirement income planning, and legacy creation.

Greg explains:

"Understanding each client’s unique circumstances is key to helping them achieve their goals. Whether it’s designing tax-efficient strategies to create a legacy for children and grandchildren, or ensuring clients don’t outlive their income in retirement, I aim to offer solutions that fit their specific needs. For seniors, I often uncover new sources of funding—such as the sale of an unwanted or unaffordable life insurance policy through a life settlement. That money can then be used for in-home health care or other pressing needs. It’s incredibly rewarding to introduce life-changing options that many people don’t even realize exist."

Explore Life Settlement Solutions

Maximize your financial freedom today

Comprehensive Life Settlement Evaluations

Our life settlement evaluation process is designed to give you a clear, honest picture of your policy’s true market value. We conduct a thorough assessment of your life insurance coverage—considering factors such as age, health, policy type, and premium cost—to determine if a life settlement is the right financial move for you. With access to a large network of competing investors, we create a bidding environment that helps maximize your potential payout. Again, there’s no cost or obligation for the evaluation—just a transparent way to explore whether your policy can be transformed into a valuable cash asset.

Expert Brokerage Services

We specialize in securing the highest possible life settlement offers by connecting policyholders with our expansive network of competitive institutional investors. Our experienced team manages the entire process, from policy evaluation to final sale, acting as trusted mediators to ensure transparency, professionalism, and maximum value. Because we create a bidding environment among multiple buyers, our clients consistently receive higher settlement payouts compared to traditional brokers. Whether you're looking to eliminate costly premiums, access cash for retirement, or simply no longer need your policy, we’re here to help you unlock its full financial potential.

Continued Financial Planning Support

Financial Guidance Post-Settlement: After helping you unlock the value of your existing life insurance policy, our support doesn’t stop there. Many of our clients choose to use a portion of their settlement to fund a more affordable final expense policy, ensuring their loved ones are protected without the burden of high premiums. Our goal is to help you turn a costly obligation into a strategic financial asset that fits your current needs and future goals.

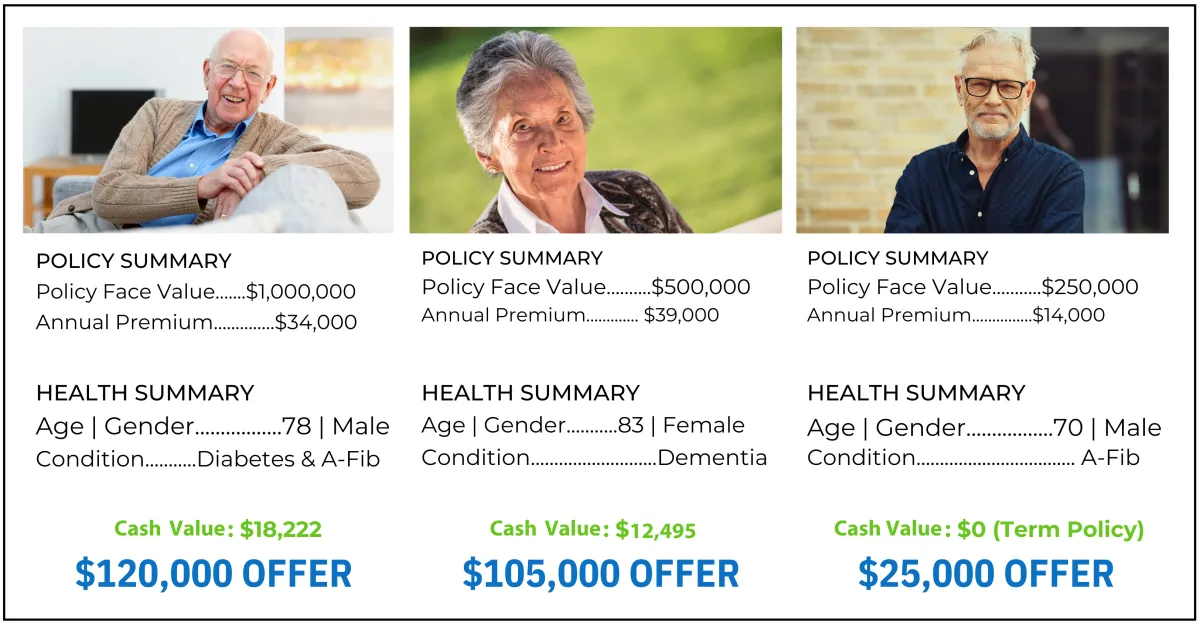

Real Settlements Provided By Our Company

FAQs

Your Questions Answered: Understanding Life Settlements

What is a life settlement?

A life settlement involves selling your life insurance policy to a third party for a value greater than its cash surrender value but less than its net death benefit.

How do I know if my policy qualifies for a life settlement?

Policies usually qualify if they are longstanding and the insured is 65 or older. We provide complementary appraisals at no cost or obligation.

Is selling my policy the only option?

No, you always have a choice! You can continue with your policy as is, convert it if that option is affordable for you, or choose a Life Settlement to receive cash from your unwanted or unaffordable policy now.

How long does the life settlement process take

The process typically takes 4-9 weeks from start to finish, where you'll receive the funds via check or wire directly into your bank account.

Are there any risks involved in life settlements?

While a life settlement can offer immediate financial benefits, there are considerations such as losing the death benefit and potential tax implications. We discuss these thoroughly to help you make an informed decision.

How is the value of my policy determined?

The value is influenced by factors like policy size, health, premium costs, and life expectancy.